Will our generation ever get a pension?

By Aurora Dagnino, Reading Time: 4 minutes

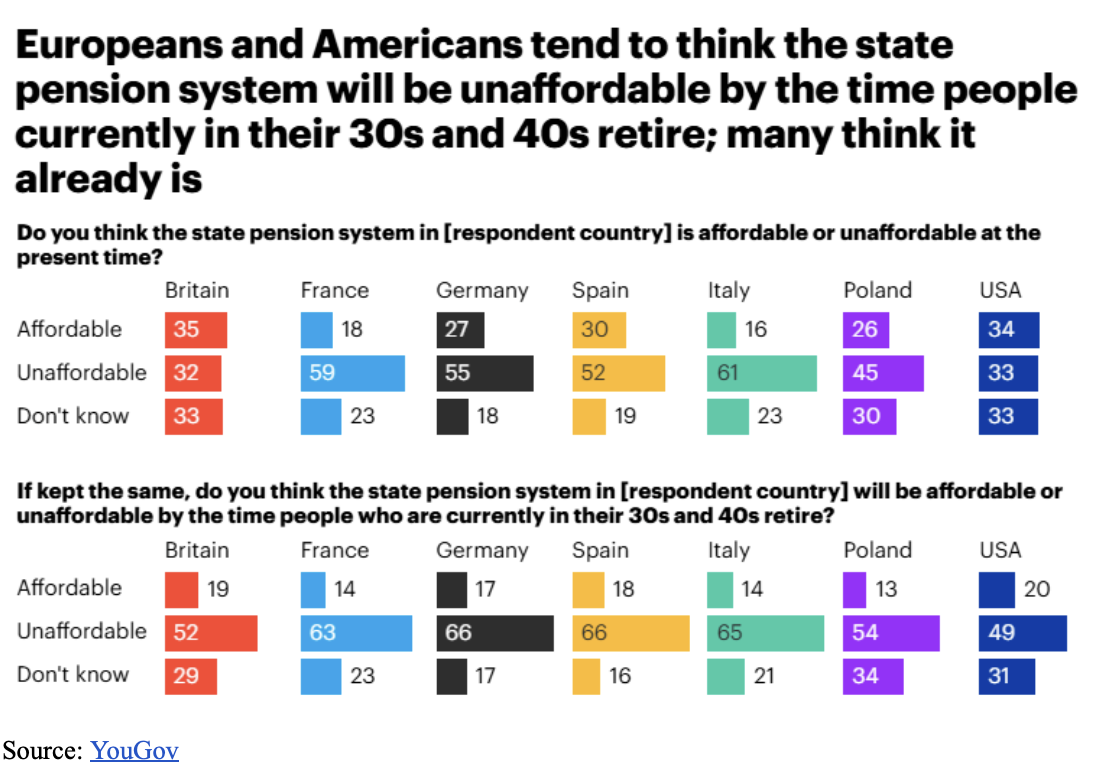

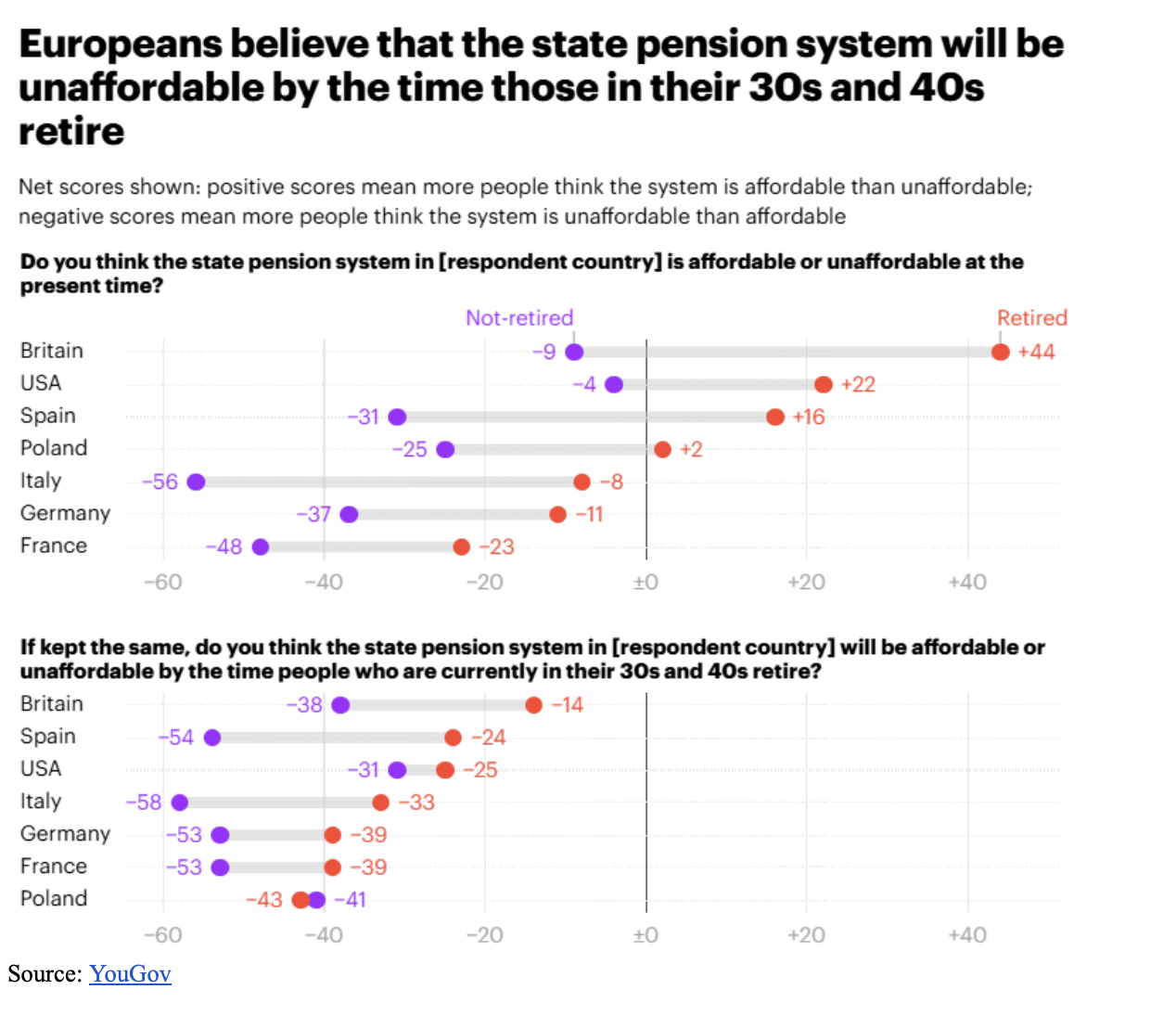

A recent survey shows that the majority of the population in Britain, France, Germany, Italy, Poland and Spain consider their pension system to be unaffordable.

Source: YouGov

As an Italian, I can definitely confirm this feeling. Many young people today have a growing perception that we will simply never get a pension. Our parents often started to work when they were barely 18, and many of them are still working. If that is the reality for them, what will it be like for us, students who likely won’t even start our careers until we are 25?

The right to a pension has been a central pillar of the European social contract for decades. But longer life spans and fewer births mean most governments can't afford to have people retiring on a full pension in their early 60s, which used to be the norm.

Moreover, the majority in each country surveyed believe that the value of their national state pensions is too low (53-83%). This is particularly true among retired people (72-88%).For this reason, especially in Italy, a lot of retired people are still working illegally after retirement. This is because the amount of pension they receive is simply not enough to financially support themselves and their family.

Source: YouGov

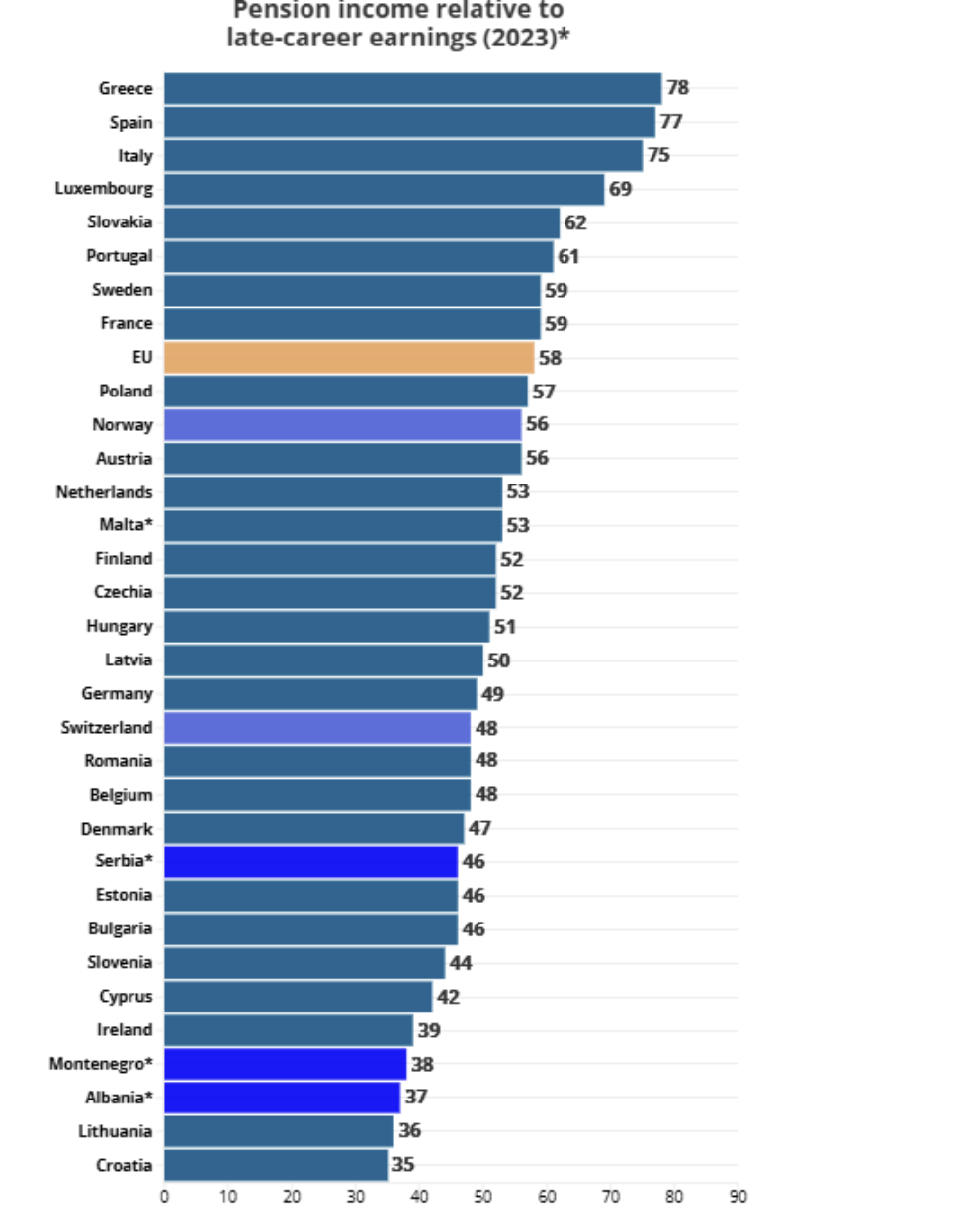

But this is not a uniquely Italian phenomenon. In many European countries, pension income is significantly lower than pre-retirement earnings from work. In 2023, the aggregate replacement ratio in the EU was 58%. This means that a person who earned €100 between the ages of 50–59 would receive €58 in pension income between the ages of 65–74.

Source: Euronews

While places like Italy and Greece offer higher pensions on paper, they are struggling to pay for them because they have some of the oldest populations in the world. Italy and Greece currently spend the largest share of their national income on pensions, around 16% of their GDP. Meanwhile, in Eastern Europe, pensions are so small that many elderly people are left with very little just to survive.

The issue of low pension is even exacerbated for women, which receive less money than men. On average, women’s pension income is 22% lower than that of men, exceeding 30% in countries such as the Netherlands, Austria, Luxembourg, Belgium, Switzerland, and Ireland.

The lowest gaps, of 10% or below, can be found in Estonia, Iceland, Slovakia, Czechia, Slovenia, and Denmark.This gap can be explained by the fact that women, when becoming mothers, usually reduce their working hours to care for children. Their wage is therefore lower, and therefore is the consequent pension earned.

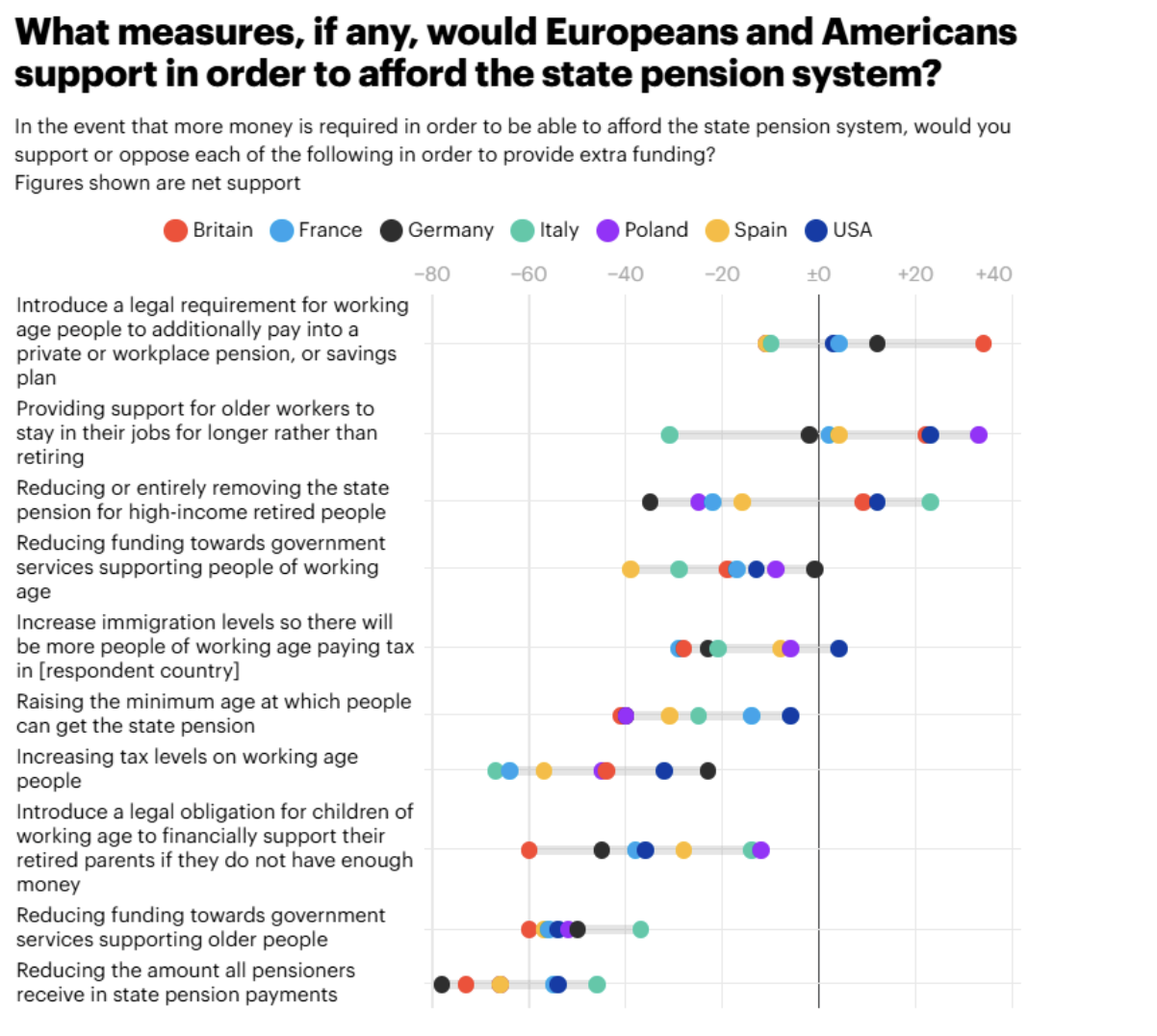

So, is there a solution ? Even though everyone recognizes that the system is in trouble, there is limited support for actions that might help correct the issue.

Source: YouGov

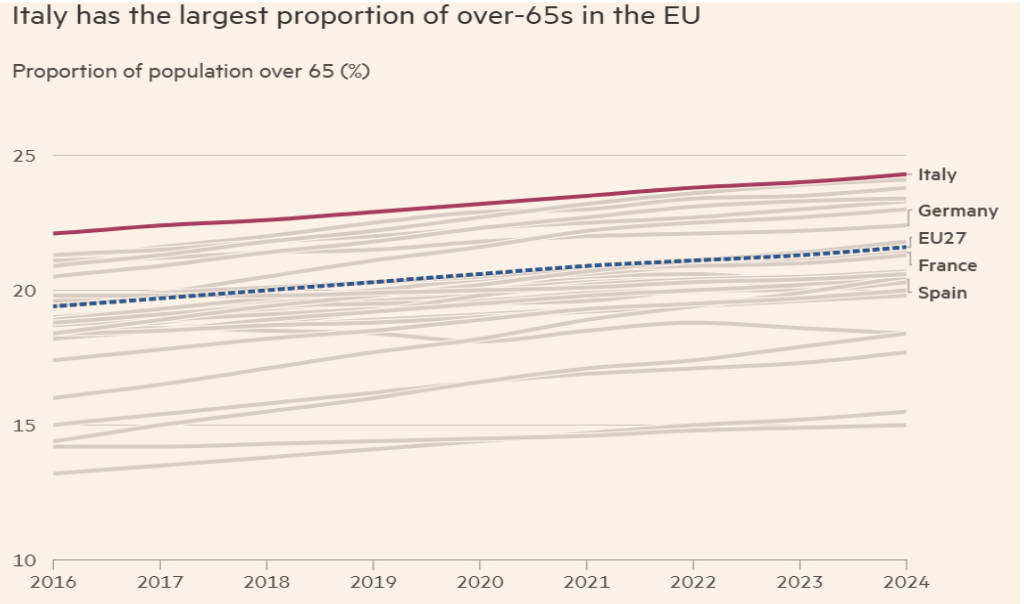

Italians are particularly hostile to attempting to support older people to stay in the workforce for longer. The logic is simple: if older people don’t retire, how are young people supposed to enter the job market? At the same time, there aren't enough young people to replace those who do retire. Italy is one of only eight EU countries where the total population has actually declined recently, and it has the highest proportion of over-65s in the entire EU

Source: Financial Times

French people are also quite reluctant to extend the retirement age and to work for longer. In 2023, a reform was introduced in 2023 to raise the retirement age from 62 to 64, without a full parliamentary vote, which caused mass protests, strikes and public anger. In 2025, the government decided to pause the reform until after the 2027 presidential election, but this did not solve the underlying problem, it simply postponed it.

Supporters of the reform argue that France must change its pension system because people live longer and fewer workers are paying into the system. Moreover, compared to many other European countries, France still has a low retirement age and relatively generous pensions, which puts pressure on public finances.

Opponents, including trade unions and many workers, argue that raising the retirement age is unfair, especially for people with physically demanding jobs or those who started working early. They also see pensions not just as an economic issue, but as a social right that defines French identity.

The problem of pensions in Europe is a very sensitive and complex topic which has an enormous impact on the state, and consequently Europe’s economy. Finding a balanced solution means looking at everything:the cost of the system to the state, the level of productivity and happiness of workers, the level of satisfaction among elderly people, the number of young people that are leaving the country and birth and death rates.